Currently Empty: $0.00

Why Math Matters More Than Market Predictions

Every financial market produces two types of traders: those who survive and grow, and those who slowly drain their accounts. What separates them is rarely talent or luck. The real separator is how well they understand numbers.

Many beginners approach trading as a guessing game, trying to forecast where price will move next. Professionals don’t trade this way. They focus on controlling losses, measuring probabilities, and applying repeatable calculations. This structured approach is what stock market math represents.

Markets will always move unpredictably. Your edge comes from how you respond to that uncertainty using logic instead of emotion.One of the main reasons traders fail is ignoring the principles of stock market math. By relying on intuition rather than calculations, they expose themselves to unnecessary risk and emotional decisions. Understanding and applying stock market math ensures that every trade is measured, consistent, and aligned with long-term goals.

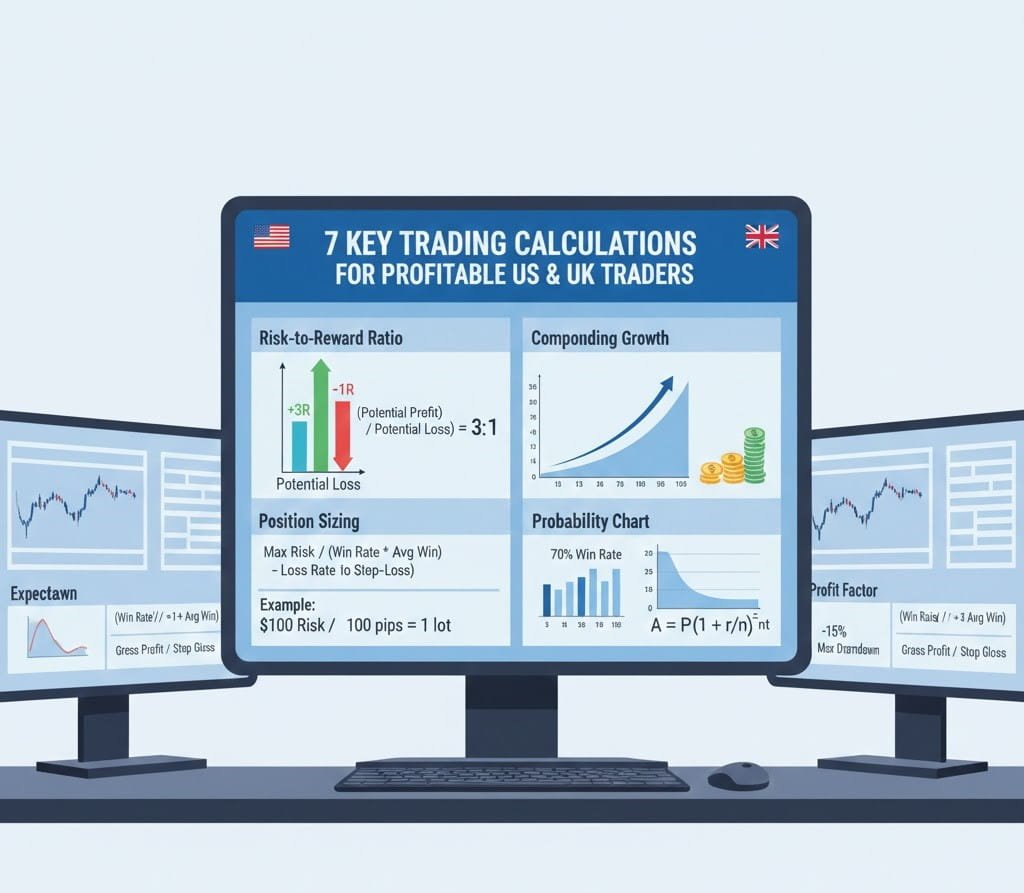

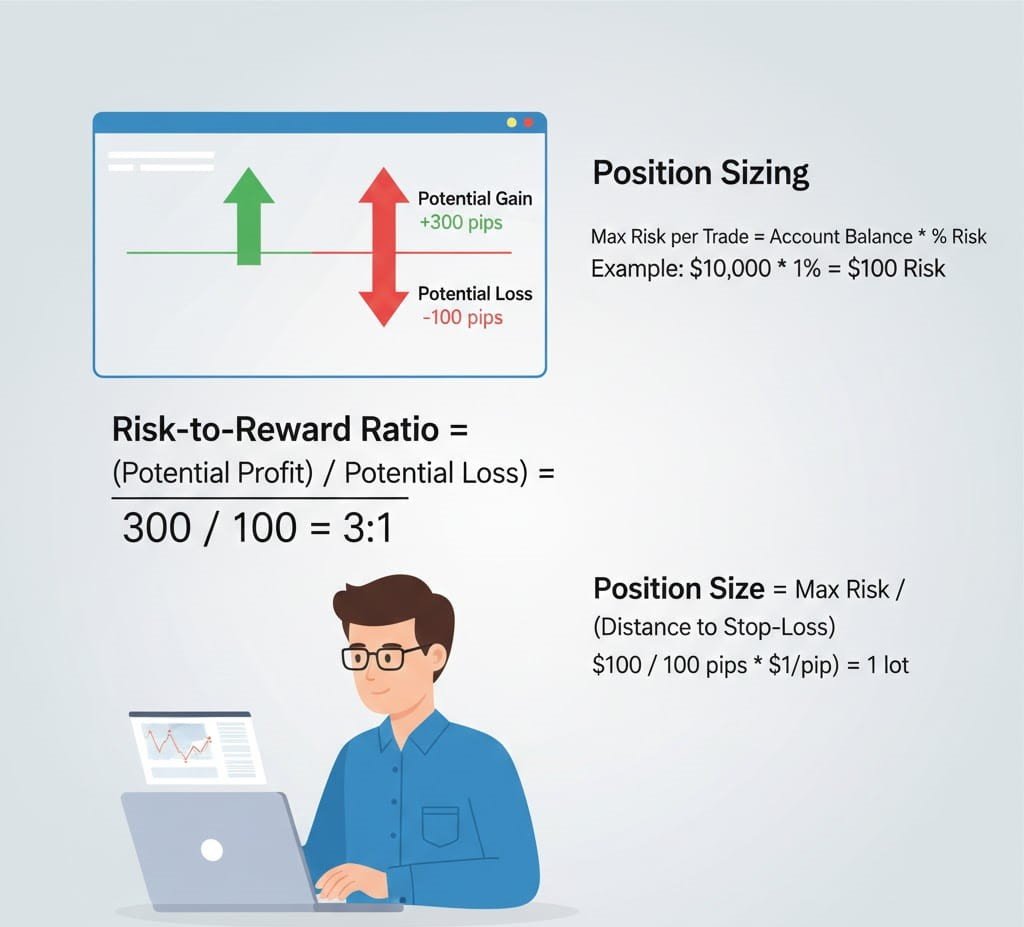

Measuring Risk and Reward Before You Trade

A trade should never be entered without knowing two things: how much you can lose and how much you can gain.

This relationship is expressed through the risk-to-reward ratio. This is where stock market math becomes practical rather than theoretical. By quantifying potential losses and expected gains before entering a position, traders remove guesswork and ensure every decision aligns with predefined risk limits.

Risk-to-Reward Calculation

Risk-to-Reward = Expected Gain ÷ Possible Loss

For instance, risking $100 to make $300 gives a 1:3 ratio.

This matters because profitability does not depend on winning often. With favorable ratios, a trader can lose more trades than they win and still grow their account. That’s why experienced traders reject setups where losses outweigh potential gains.

Position Sizing: Limiting Damage from Bad Trades

Position sizing answers a critical question: how much should I trade?

Rather than guessing, professionals use a formula that links account size, acceptable risk, and stop-loss distance.

Position Size Formula

Position Size = (Account Balance × Risk %) ÷ Stop-Loss Value

Example:

Account balance: $50,000

Risk per trade: 1% ($500)

Stop-loss distance: $10

Position size = 500 ÷ 10 = 50 shares

This calculation prevents any single trade from causing serious harm and allows traders to remain consistent over hundreds of trades.

Trading as a Probability Exercise

Markets do not reward perfection. They reward consistency.

Instead of asking, “Will this trade win?” professionals ask, “Is this strategy profitable over many trades?”

That’s where expectancy comes in.

Expectancy Formula

Expectancy = (Probability of Win × Average Gain) − (Probability of Loss × Average Loss)

A positive expectancy means the strategy makes money over time, even if losses occur frequently. This mindset removes emotional attachment to individual trades.

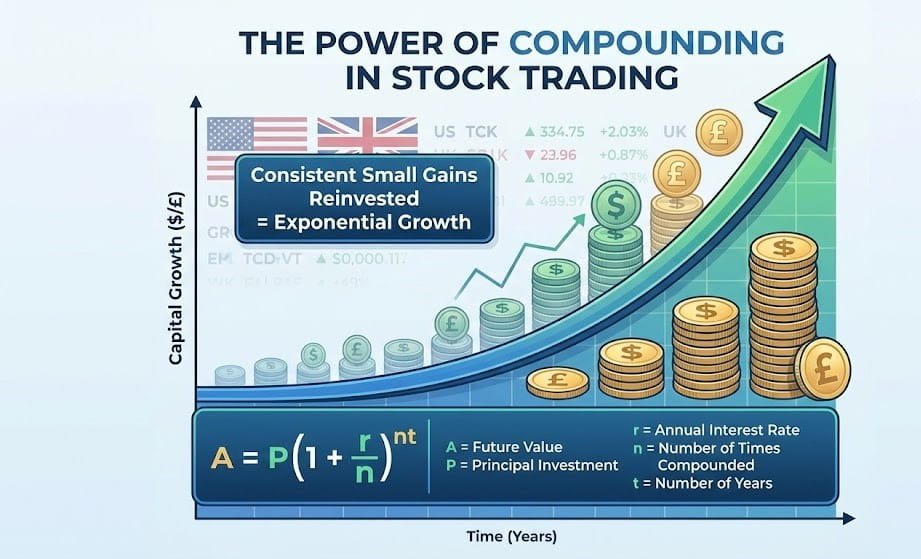

Compounding: The Silent Growth Engine

Compounding is what allows small, steady gains to turn into meaningful capital growth.

Compounding Equation

Future Value = Starting Capital × (1 + Rate of Return)ⁿ

Traders who prioritize steady performance benefit far more from compounding than those who chase large, unstable profits. Time and consistency do most of the heavy lifting.

Understanding Your Break-Even Point

Losses are unavoidable in trading. What matters is knowing how many losses your strategy can tolerate.

Break-Even Win Rate Formula

Break-Even Rate = Risk ÷ (Risk + Reward)

With a 1:3 setup, the break-even rate is:

1 ÷ (1 + 3) = 25%

This means winning just one out of four trades prevents losses overall. Knowing this helps traders stay calm during drawdowns.

Volatility: Adjusting Risk to Market Conditions

Volatility describes how aggressively prices move. Higher volatility increases both opportunity and danger.

Professional traders respond by:

Widening or tightening stop-losses

Reducing position sizes

Trading less frequently

Statistical tools like standard deviation help quantify volatility so decisions remain objective rather than emotional.

Moving Averages: Simplifying Market Direction

Moving averages reduce noise and highlight trends.

Simple Moving Average (SMA)

SMA = Sum of Prices ÷ Number of Periods

They help traders:

Stay aligned with momentum

Avoid trading against dominant price movement

Because of their simplicity, moving averages remain widely used across all markets.

Risk Control: The Foundation of Long-Term Survival

No strategy survives without risk control.

Most professional traders limit risk to 1–2% per trade. This ensures they can withstand losing streaks without blowing up their account.

Without proper risk limits, even a strong strategy can fail due to poor execution.

Why Traders Lose When They Ignore the Math

Most trading failures come from avoidable errors:

❌ Oversizing trades

❌ Ignoring calculated risk levels

❌ Emotional decision-making

❌ No statistical evaluation

❌ Trying to recover losses quickly

These problems are mathematical, not market-related.

Why These Principles Apply to Every Market

Whether you trade US stocks, UK equities, commodities, or digital assets, the math remains unchanged. Instruments differ, but risk, probability, and compounding are universal.

That’s why experienced traders trust numbers more than opinions or news headlines.

Trading Success Is Built on Structure, Not Speculation

Financial markets reward discipline far more than bold predictions. Every day, traders in the US and UK place thousands of trades, yet only a small percentage achieve consistent profitability. The difference is not access to secret indicators or insider information. It’s the presence of structure in decision-making.

Successful trading operates within clear rules. These rules define how much to risk, when to exit, and how to stay objective during uncertainty. Without this structure, emotions dominate decisions, often leading to unnecessary losses and inconsistency.

In professional trading environments, decisions are driven by calculations rather than opinions. Numbers provide clarity where emotions create confusion. This numerical foundation is what separates calculated operators from impulsive gamblers in modern financial markets.

Final Thoughts: Trade Like an Operator, Not a Gambler

Trading is not about predicting the future. It’s about managing uncertainty.

When you rely on stock market math, you replace guesswork with structure. Over time, this approach creates consistency, confidence, and control the traits that define professional traders.

If your goal is long-term success in US or UK markets, let calculations guide every decision.

FAQs

- Is advanced mathematics required for trading?

No. Basic arithmetic, probability, and discipline are enough. - What calculations do professionals rely on most?

Risk-to-reward, position sizing, expectancy, and volatility measurement. - Is trading more calculation-driven than investing?

Yes. Trading demands frequent risk and probability assessment, while investing focuses on long-term fundamentals.